Securing Your Retirement:

The Fixed Index Annuity Solution

The #1 Fear in Retirement:

Will My Money Last?

You’ve spent decades building your retirement nest egg. Now the priority is no longer rapid growth — it’s protecting what you’ve built and ensuring it lasts your entire lifetime. For millions of retirees, the greatest financial fear is outliving their savings.

You’ve transitioned from the accumulation phase to the income and preservation phase. That shift requires a new strategy, one focused on stability, protection, and predictable income.

The question is: Is your money still working for you, or is it working against you?

The Danger of “Staying in the Market” During Retirement

Keeping your retirement savings fully exposed to the stock market may have been effective for long‑term growth, but in retirement it introduces a serious threat: Sequence of Returns Risk.

What It Means

You experience poor or negative market returns early in retirement — precisely when you begin withdrawing income.

Why It’s So Dangerous

When markets drop and you withdraw funds at the same time, you’re forced to sell more shares at lower prices. This can permanently weaken your portfolio’s ability to recover.

In retirement, you no longer have the luxury of waiting years for markets to bounce back. A downturn in the first few years can cause irreversible damage to your long‑term financial plan.

How Your Broker Makes Money from Your Nest Egg

It’s important to understand how your financial professional is compensated. Many work on an Assets Under Management (AUM) model.

How It Works:

You pay a percentage of your portfolio value each year (commonly 1%).

The Conflict:

If your $1,000,000 portfolio drops 30% during a market downturn, your advisor’s fee drops — but you’re the one absorbing 100% of the loss.

Their business model may rely on keeping your money in the market, even when removing risk may be the safer move for your retirement goals.

At this stage of life, the goal should be to eliminate unnecessary risk — not simply manage it.

The Solution:

The Next Step for Your Retirement Savings

A Fixed Index Annuity (FIA) is a retirement income tool designed specifically to help protect your savings from market volatility while still offering the potential for growth.

An FIA is engineered to solve two critical retirement challenges:

- Protecting your principal from market downturns.

- Providing reasonable growth potential to help your income keep pace with inflation

How an FIA Protects Your Principal

The core benefit of an FIA is simple:

You cannot lose money due to market declines.

This protection is powered by a feature known as the Annual Reset, which locks in any gains each year and prevents them from being lost during future downturns.

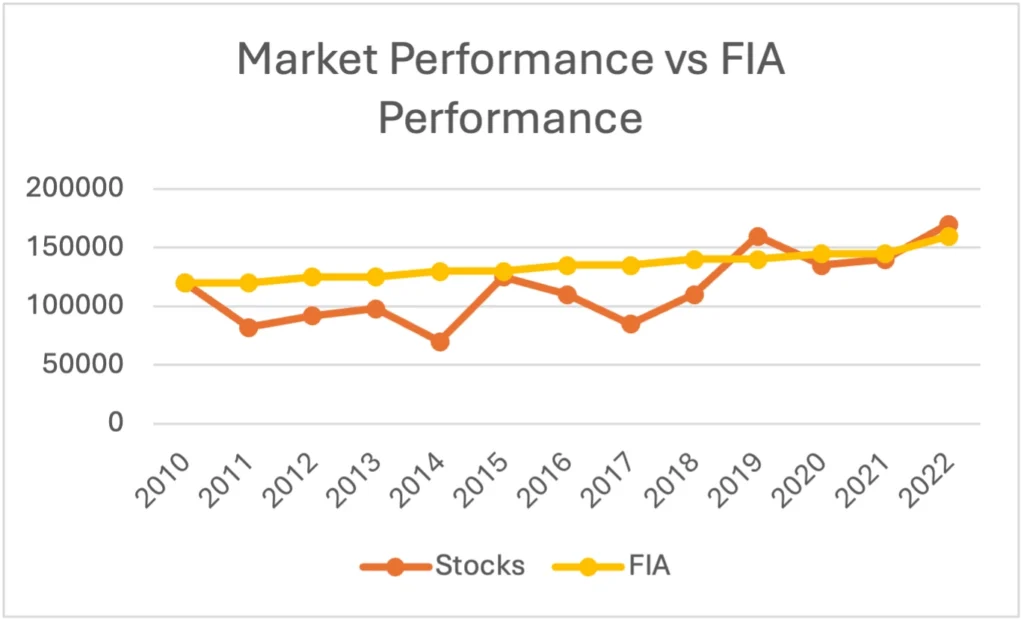

Graph 1:

The Power of Zero -

Protecting Your Savings

Imagine you invested $100,000 in 2010, right before a major market crash.

- Stock Market (Dotted Line): Your investment would have lost significant value in 2008 and taken years just to get back to even.

- Fixed Index Annuity (Solid Line): Your principal is protected. When the market goes down, your account value simply stays level. You don’t lose money due to market volatility. This is often called the “Annual Reset” feature. Any interest you’ve earned in previous years is also locked in and cannot be lost.

“With an FIA, zero is your hero.”

How You Participate in Market Gains

Protection is key, but you also need growth. An FIA links your interest crediting to the performance of a market index (like the S&P 500) without direct market participation.

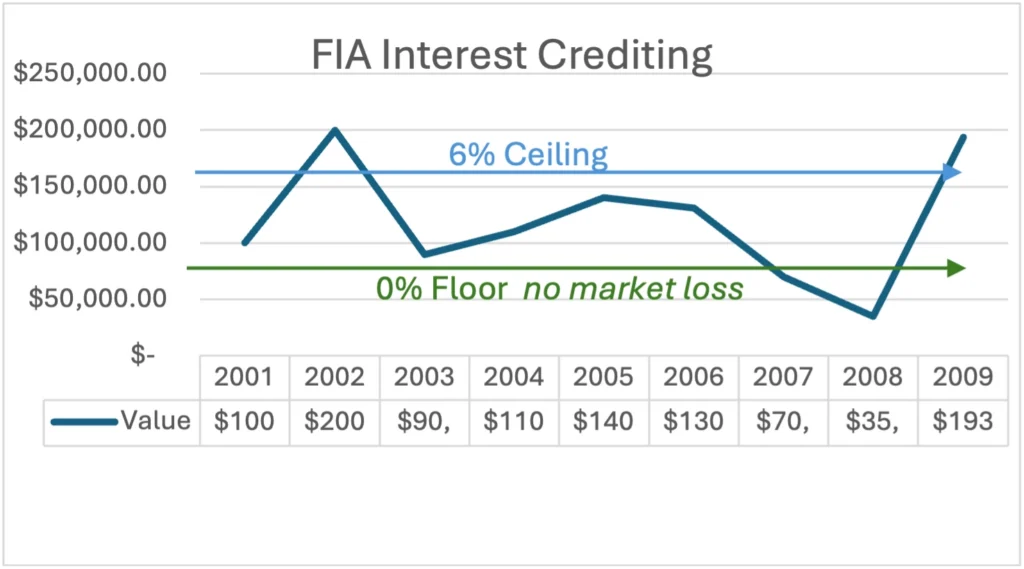

Graph 2:

Capturing the Upside

If the index performance is 12% and you have a 6% ceiling, your account is credited with 6% interest for that year.

If the index performance is negative, you are credited 0%. You don’t lose anything.

This allows you to enjoy a reasonable rate of return without the risk of loss.

Pros and Cons of Fixed Index Annuities

Like any financial product, FIAs have advantages and disadvantages.

Pros

- Principal Protection: Your account cannot lose money due to market downturns.

- Tax‑Deferred Growth: Earnings grow without taxation until withdrawn.

- Upside Potential: Interest is linked to index performance.

- Guaranteed Income Stream: Convert your annuity into a lifetime income you cannot outlive.

- Locked‑In Gains: Credited interest can never be taken away in future down years.

Cons

- Limited Upside: Gains are capped.

- Surrender Charges: Early withdrawals may incur penalties.

- Complexity: Contracts include multiple features and terms.

- Possible Fees: Some optional riders come with additional costs.

- Reduced Liquidity: Access to funds can be limited during surrender periods.

A Powerful Bonus: Help with Long-Term Care Costs

Many Fixed Index Annuities offer valuable long‑term care benefits, often overlooked by retirees:

Income Doublers or Enhanced Payouts:

Some FIAs include riders (sometimes at no extra cost) that can double your guaranteed income for a period of time — often 5 years — if you cannot perform certain Activities of Daily Living (ADLs), such as bathing or dressing.

Asset Protection for Health Events:

This allows your retirement income source to help cover long‑term care needs without purchasing a separate LTC policy.

This dual‑purpose benefit can create significant financial stability during health‑related challenges.

Is a Fixed Index Annuity the Right Next Step for You?

Moving a portion of your retirement savings from the market to a Fixed Index Annuity is a strategic move to:

Protect Your Principal

Avoid the devastating impact of a market crash.

Secure a Reasonable Return

Participate in market gains without market risk.

Plan for Long-Term Care

Add a layer of protection for future healthcare costs.

Create a Guaranteed Income

Guarantee a steady, reliable paycheck for life.

If your priority has shifted from wealth accumulation to wealth preservation, an FIA may be the strategic solution that secures your financial future.

Disclaimer: This presentation is for informational purposes only. Fixed Index Annuities are complex financial instruments. It is essential to discuss your specific situation with a qualified and licensed financial professional before making any investment decisions. Guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company.